from data to discoveries:

safeAML is changing the game for money laundering.

safeAML is the result of years for research and legal consultation. Together with our amazing partners we developed a solution that is compliant with all data protection laws and at the same time lean in data usage. safeAML enables banks for the first time to digitally connect suspicious data and rebuild the networks of criminal transactions.

Prepare for a game-changing advancement in money laundering detection with safeAML, the innovative product stemming from the accomplished research initiative, safeFBDC. During the three years of the project, spotixx worked with Deutsche Börse and Hawk to develop a cutting-edge AML solution on shared data. Leveraging the collaborative efforts of leading financial institutions in Germany, safeAML will enable banks to seamlessly correlate suspicious transactions and initiate source of funds checks. As development progresses, safeAML will equip banks with the capability to unveil concealed patterns of money laundering activities. Strict data protection protocols are adhered to at all times.

how does safeAML work?

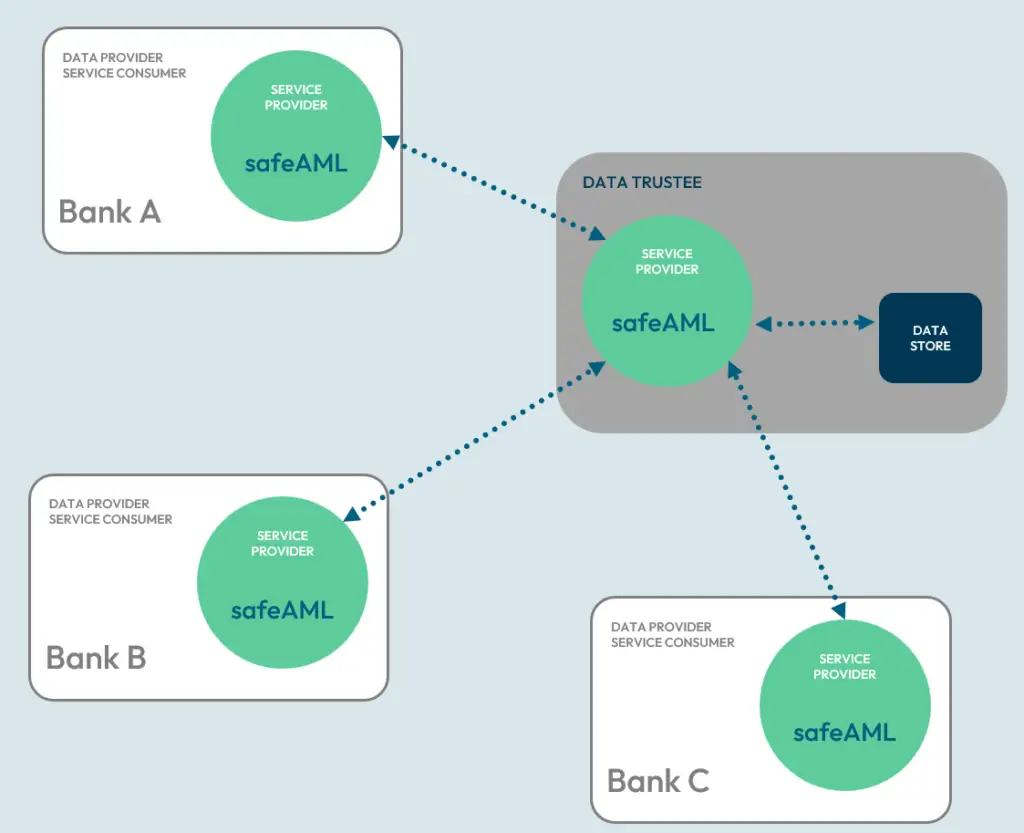

Step 1: Bank A sends suspicious transactions to safeAML.

Step 2: safeAML requests connected transactions from Banks B and C in multiple iterations.

Step 3: safeAML stores anonymised network in a trusted data store.

Step 4: safeAML creates graphs and returns to Bank A.

Step 5: Investigator at Bank A reviews graphs and executes next neccesary steps.

key features of safeAML.

safeAML enables banks to seamlessly correlate suspicious transactions and investigate sources of funds. As development progresses, the application will enable banks to uncover hidden patterns of money laundering activity, all while adhering to strict data protection protocols.

Committed to data privacy, safeAML complies with GDPR regulations, ensuring that personal data is handled with the highest level of security and integrity.

Automate source of

funds checks.

Seamlessly correlate suspicious transactions across multi-bank data.

Uncover hidden network patterns of money laundering activities.

safeAML.

Learn more about safeAML:

the game-changing innovation in fighting money laundering.

Questions about safeAML answered by Stefan Klaeser and Patrick Töniges,

Managing Directors of spotixx.

What is safeAML?

safeAML is the result of years for research and legal consultation. Together with our amazing partners we developed a solution that is compliant with all data protection laws and at the same time lean in data usage. safeAML enables banks for the first time to digitally connect suspicious data and rebuild the networks of criminal transactions via the neutral data trustee.

How is safeAML different to previous processes?

The existing process of requesting the origin of funds is done manually, by phone or email. This way of investigating criminal acitivity is prone to mistakes, takes a lot of time and is inefficient. With safeAML, we are digitizing this fundamental procedure, making it asynchronous and thus faster.

What are the key features that differentiate safeAML from other AML solutions on the market?

As it is now, every bank has its in-house software solution to detect money laundering and fraud. This data only exists within the banks in silos. Connecting this data across banks has previously not been possible due to data protection laws and the general sensitivity of bank transactions. The development of safeAML now enables banks to connect their data – in cases of suspicious transactions – in a fast, secure, and most importantly, compliant way that is based on minimal data usage.

Could you describe a typical use case for safeAML and its impact on financial institutions?

When using safeAML, the investigator from a bank simply enters a suspicious seed transaction of their customer account. safeAML then iteratively collects information about accounts and transactions from involved banks. Within a short amount of time, the investigator receives an insightful network graph, that condenses masses of network information into meaningful connections between actors in the network. With suspicions confirmed and documented, further necessary steps with the regulatory institutions can then more easily be initiated.

How does safeAML leverage AI to enhance AML compliance?

safeAML delivers a comprehensive graph in an interactive UI that the investigator can modify, search, and query for information. Additionally, it highlights useful information about relationships, such as aggregations of behavior, statistical indicators, and topologies.

In what way does safeAML ensure the security and privacy of the data it processes?

The data exchange is fully encrypted and takes place through a specifically created data trustee that is run by the state of Hesse. Banks can only see a limited amount of information, such as the BIC numbers. IBANs are only shown, if the bank has the according privilege to see them. During the processing, all information is encrypted and anonymized, and every bank holds its own encryption key.

How do you see the role of AI evolving in the fight against financial crime in the next few years?

The speed at which artificial intelligence is currently evolving is unprecedented and offers incredible potential to change a market that is slow to adapt to change. But with the successful implementation of reliable and understandable AI, that supports humans in their daily work and gives them better results, anything is possible. We believe that fighting financial crime is an ongoing evolutionary process, as fraudsters and criminals try to exploit any potential flaw in our systems. With AI, these systems can detect fraudulent behavior faster and more accurately, thus enabling investigators to improve reactions and speed up criminal investigations.

What future enhancements or features can users expect from safeAML as it continues to evolve?

With the right legal framework and the cooperation between banks and investigative bodies such as the FIU and AMLA, we see a high potential to beat organized crime and destroy existing structures and flows of money into illegal transactions. With safeAML, we take a giant first step to connect previously untapped data potential, that will unveil and expose criminal activities. As we develop safeAML further and engage more banks on an international level, investigational speed will improve and new schemes can be detected faster, making it ever more difficult for the criminal mind to pursue their activities.

want to know more?

Reach out to our experienced consultants Leo Hattenbach and Ruppert Jaeschke to find our more about safeAML and how AI can level you up in the money laundering detection and prevention game. Use our message form here or click on their image to find them on LinkedIn.

Reach out to our experienced consultants Leo Hattenbach and Ruppert Jaeschke to find our more about safeAML and how AI can level you up in the money laundering detection and prevention game. Use our message form here or click on their name to find them on LinkedIn.