from data to detection: AI-powered fraud prevention.

Our passion at spotixx is to protect your business and your customers against financial crime. Our expertise lies in the holistic handling of all aspects of fraud management starting with developing and maintaining AI models, building and refining fraud rule sets and efficiently running your fraud operations.

Leave the full scope of your fraud management with us and we reduce your total cost of fraud through improved detection rates, lower false positive rates and efficient operations.

maximizing detection, minimizing costs.

We start with a focus on your profitability: you’ll save at least twice your spending through reduced fraud expenses, while we simultaneously work to boost customer satisfaction and safeguard your reputation. We make your operational fraud processes highly efficient, too. Years of experience have enabled our fraud management to process suspicious activity rapidly, cost-efficiently, and in a customer-friendly way. We optimize for cost effectiveness by carefully balancing a high fraud detection rate with the need for efficient and accurate operations.

our unique blend: fraud detection with AI and know-how.

What sets us apart is our unique combination of AI expertise and anti-financial crime domain knowledge. With more than 20 years of experience in operational fraud management, our fraud detection experts know how to harness the full power of AI in the fight against fraud.

However, AI alone is not enough—only the combination of fraud domain expertise and AI competency truly wins.

At spotixx, we understand how to operationalize AI successfully and seamlessly integrate it into your agile anti-fraud management for best detection results.

In short: Our AI successfully and seamlessly works alongside your anti-fraud processes. Tightly connected operations are a key success factor in reducing overall cost for fraud management.

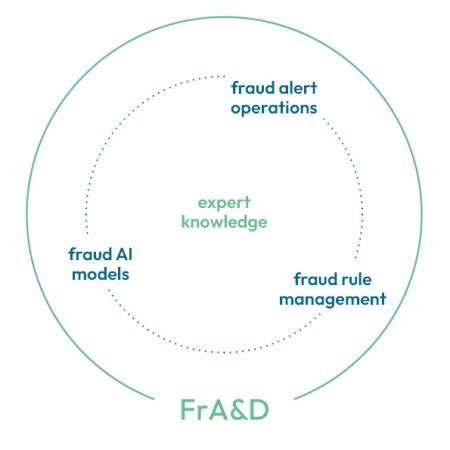

a holistic approach to fraud management.

Hybrid fraud detection, combining rules-based systems and AI models, delivers the best results by leveraging their individual strengths. Rules provide structure, AI models detect emerging patterns, and expert teams ensure context-driven decision-making.

Together they make a seamless and adaptive fraud prevention, which enables faster responses to threats, fewer false positives, and improved compliance. Our expert teams in these three areas collaborate closely and ensure that insights from one feed into the others – refining detection methods in real time.

AI-driven insights for superior fraud detection accuracy and reduced false positives.

The use of AI in fraud detection enhances significantly the ability to identify and prevent fraudulent activities with greater accuracy and efficiency. One of the key components in this process is feature creation, where relevant data points are extracted and transformed into meaningful variables that help AI models differentiate between legitimate and fraudulent transactions.

To maintain high detection accuracy, fraud detection systems require the development and regular recalibration of AI models. As fraud patterns continuously evolve, AI models must be updated and fine-tuned to adapt to new threats.

A crucial aspect of AI-driven fraud detection is comprehensive documentation of AI models, including Model Governance and Model Risk Management. This ensures transparency, regulatory compliance, and the ability to explain model decisions when needed.

By combining advanced feature engineering, AI model recalibration, customer-specific adaptations, thorough documentation, and continuous performance monitoring, organizations can leverage AI to enhance fraud detection capabilities, minimize financial risks, and improve overall security.

dynamic fraud detection rules that adapt to emerging threats in real-time, ensuring a fast and adaptive fraud prevention strategy.

Fraud rules management is a dynamic and continuous process aimed at preventing and detecting fraudulent activities through a structured and adaptable rule framework. To ensure effectiveness, the rule set is updated regularly as needed, allowing banks to stay ahead of emerging fraud patterns. A key aspect of fraud prevention is the timely response to new fraud cases and evolving fraudulent tactics, which requires continuous monitoring and rapid adjustments to detection rules.

Data analysis and in-depth investigations play a crucial role in refining fraud detection strategies. By evaluating transactional data and identifying suspicious patterns spotixx can enhance bank’s fraud detection capabilities. Ongoing rule maintenance, known as rule lifecycle management, ensures that fraud prevention rules remain effective over time.

To assess the efficiency of fraud rules, organizations must implement performance measurement and reporting mechanisms. Regular evaluation of key metrics helps optimize rule effectiveness while minimizing false positives.

The integration of AI models into the fraud rule framework has become increasingly important, as machine learning algorithms can identify complex fraud patterns that traditional rule-based systems might overlook. AI-driven approaches enable adaptive fraud detection, improving accuracy and response times.

skilled analysts and efficient processes to investigate alerts and minimize losses.

Fraud Operations play a crucial role in detecting, managing, and preventing fraudulent activities by handling alerts, coordinating investigations, and ensuring compliance with regulatory requirements and reporting.

The process begins with the handling of fraud alerts, where suspicious activities are reviewed and assessed for potential fraudulent behavior. By integrating alert handling, customer communication, investigation, legal preparation, and reporting, Fraud Operations serves as a critical defense mechanism against financial crime, protecting both businesses and their customers.

More information on our operations can be found here.

FrA&D: our ai-driven Fraud Analytics & Detection framework.

FrA&D our ai-driven Fraud Analytics & Detection framework.

Central to our success is our AI-driven FrA&D Framework, a bespoke toolbox designed for efficient and effective fraud detection.

This selection of tools accelerates fraud prevention projects, enhances fraud detection capabilities, and supports the entire AI modeling and rule management lifecycle.

An automated rule discovery engine complements the toolbox for always up-to-date and performant detection rules.

With years of expertise, we ensure that our clients reach their fraud prevention goals faster and more cost-effectively. Trust spotixx to safeguard your business and optimize fraud management, reducing fraud-related losses while maximizing operational efficiency.

Central to our success is our AI-driven FrA&D Framework, a bespoke toolbox designed for efficient and effective fraud detection.

This selection of tools accelerates fraud prevention projects, enhances fraud detection capabilities, and supports the entire AI modeling and rule management lifecycle.

An automated rule discovery engine complements the toolbox for always up-to-date and performant detection rules.

With years of expertise, we ensure that our clients reach their fraud prevention goals faster and more cost-effectively. Trust spotixx to safeguard your business and optimize fraud management, reducing fraud-related losses while maximizing operational efficiency.

how can we help you?

Do you want to know more, about how we can help you and your company to fight fraud and money laundering? Just leave us as message here and we will get back to you asap.