A platform to connect financial institutions, combine data, and combat financial crime.

faster threat response.

Rapidly share threat information between organisations, creating a joint barrier to fraud attacks.

improved accuracy.

Supercharge AML, Fraud detection and KYC with combined risk indicators and network discovery.

reduced costs.

Prevent fraud losses and downstream processing costs, reduce investigation times and automate first line AML investigations.

Europol has identified 821 „most threatening“ criminal networks with over 25,000 members operating across the EU.

They all use sophisticated methods of concealment that exploit the siloed nature of information in the financial system. The patterns of their activity are extremely hard to detect by any one single organisation.

Now we provide a way to fight back: by combining intelligence and resources we can bring the networks to light and close the gaps in our defences.

Share Data, Fight Crime.

the new standard of

data privacy and

security technology.

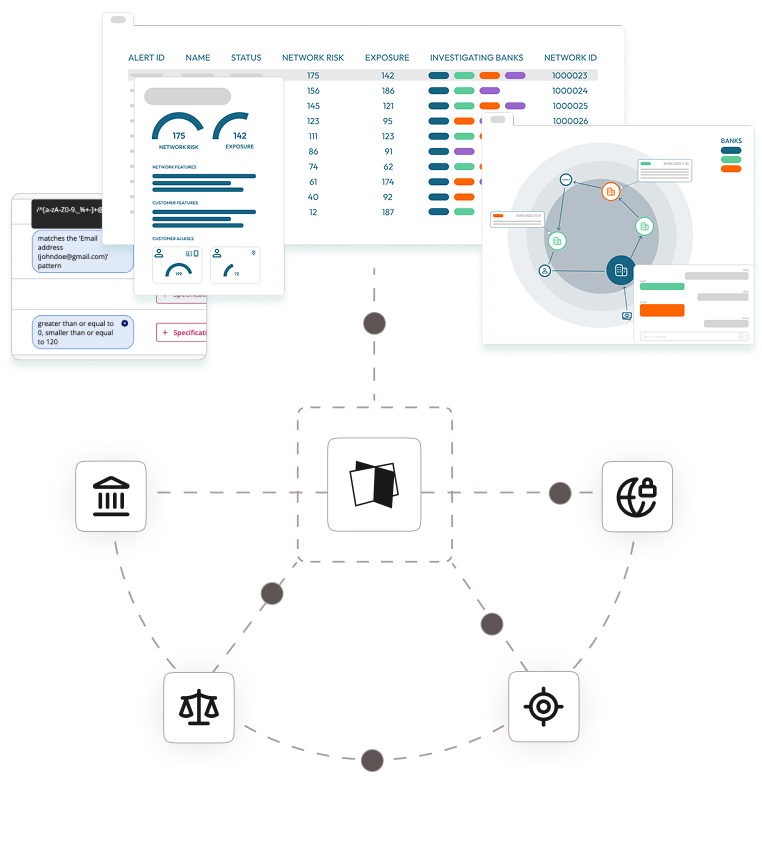

Our platform is built on Roseman Labs’ encrypted computing platform, a certified, award-winning technology that keeps data encrypted even during analysis. This ensures the highest standard of GDPR compliance and regulatory trust, proven by ISO 27001, BSPA certification, and two Dutch National Privacy Awards.

With Roseman Labs as the foundation, we enable institutions to collaborate securely without ever sharing raw data.

Data is combined on a de-centralised platform and remains encrypted at all times, even during computation. Only the important insights from the data are shared, allowing institutions to focus on the value outcomes of combing data, not the risks to data privacy or security. With Roseman Labs encrypted computing technology institutions do not have to worry about sharing data with one another.

Now making connections is thus like a puzzle without seeing the pieces, you only see the result in the end.

shared data applied.

Find out how

our platform supports

your institution

at each step of the fight against financial crime.

Stop payments to known fraudulent accounts.

Payments Screening.

Find and de-risk hidden fraud accounts.

Customer Screening.

Automate first line AML investigations.

Alert Automation.

Improve the speed and accuracy of investigations, and provide the FIU with connected SARs.

Collaborative Investigation.

Stop criminals from opening accounts.

KYC.

FAQs.

what is special about the spotixx data sharing platform, and how does it help fight financial crime?

Our technology platform that provides additive value to anti financial crime operations by combining data from multiple institutions to reveal new insights that improve accuracy of detection, and reduce cost of investigations. We help Banks and other obliged entities to improve operations across Fraud, AML and KYC, by providing new insights that can only be discovered from the combination of data across multiple organisations. These insights are integrated directly with AFC operations, such as fraud and AML detection, investigations, and customer onboarding and risk management.

how does the spotixx data sharing solution ensure secure data sharing for banks and financial institutions?

The platform is powered by a new type of privacy enhancing technology called encrypted computing that allows data to be combined without being shared.

What benefits do organizations gain from using the spotixx platform in AML and fraud prevention?

The platform helps banks and other obliged entities improve operations across Fraud, AML and KYC, by providing new insights that can only be discovered from the combination of data across multiple organisations.

how does Roseman Lab’s encrypted computing differ from other traditional data-trustee models?

Unlike traditional data-trustee models, encrypted computed by Roseman Labs enables secure, decentralized collaboration. No single party holds raw data, and sensitive information remains encrypted even during analysis.

Who can join and use the spotixx platform for anti-financial crime partnerships?

The platform is for any institutions that have a vested interest or responsibility in the detection of financial crime. These can include institutions that are directly obliged under the AMLR or PSR regulations, such as banks, payment service providers, cryptocurrency exchanges, gambling, or online marketplaces. Or it can include public bodies such as FIUs and law enforcement who must ultimately determine whether a crime has been committed.

how does the spotixx data sharing solution support collaboration for better AML compliance?

The main challenge in AML compliance thus far has been the lack of sufficient data points to conclude an investigation using local information alone. Banks regularly have to check manually with other Banks to disprove suspicion of their customers, known as the RFI process.

The spotixx platform can solve this problem by intelligently analysing the networks of activity between banks, and providing concrete conclusions that can lead to investigation automation or streamlining. In many cases this will lead to the safe auto-closure of certain very low risk AML alerts without the need for human guidance.

how does the spotixx platform support collaboration for better KYC compliance?

During a standard onboarding workflow to screen customer applications, like a credit check, the same PII information from other use cases can be used. If they are cross-referenced with other risk indicators from combined data, you get the chance to know criminals before they can commit crimes in your institute. High risk accounts can thus be monitored very tightly or outrightly blocked.

why is data cooperation important in detecting complex financial crime networks?

The spotixx platform balances compliance, privacy, and collaboration, turning legal and competitive barriers into new sources of collective defense. The level of cooperation that is now digitally possible brings to light hidden criminal networks that span across institutions and countries and have long enough thrived on the siloed nature of financial structures.

what regulations and laws support secure data collaboration with the spotixx platform?

In 2027, the new AML Regulation (AMLR) will take effect, including Article 75 which enables data-sharing partnerships.

Interpretations are still evolving – but with spotixx and our partner Roseman Labs, you’re already prepared. Our platform’s encrypted computing approach ensures maximum protection of sensitive data and secure, controlled access – today and tomorrow. Of course all of this is also in accordance with the GDPR.

What is Article 75 AMLR and when does it come into effect?

Article 75 of the new Anti-Money Laundering Regulation (AMLR) is a groundbreaking provision that will take effect in 2027. It explicitly enables financial institutions and other obliged entities to share data for the purpose of preventing and detecting money laundering and terrorist financing. This marks a significant shift from previous regulations, where data sharing was often unclear or restricted. Article 75 provides a clear legal framework for collaborative anti-financial crime efforts, allowing institutions to work together more effectively while maintaining compliance with privacy regulations like GDPR.

Can the spotixx data sharing platform help us take advantage of Article 75 AMLR before our competitors?

bsolutely. Article 75 AMLR creates a new competitive landscape where institutions that collaborate effectively will have a significant advantage in detecting and preventing financial crime. The Spotixx data sharing platform allows you to establish these partnerships today, giving you early access to cross-institutional insights that reveal criminal networks and suspicious patterns others simply cannot see. Early adopters will benefit from reduced false positives, faster investigations, lower operational costs, and stronger risk management – all while competitors wait for 2027 or struggle with compliance uncertainties. In the fight against financial crime, being proactive isn’t just smart – it’s essential.

Is the spotixx data sharing platform already compliant with Article 75 AMLR requirements?

Yes. The spotixx data sharing platform is designed with Article 75 AMLR at its core. Our encrypted computing technology ensures that data collaboration happens in a way that satisfies both the enabling provisions of Article 75 and the strict privacy requirements of GDPR. We provide secure, controlled access to combined data insights without any institution exposing their raw customer data to others. As regulatory interpretations continue to develop toward 2027, our platform’s architecture ensures maximum flexibility and protection. You’re not just compliant for today-you’re future-proofed for tomorrow’s regulatory landscape.

I still have another question, that is not answered here. Who can help me?

We are happy to help you and answer all questions you might have. Just leave us a message below.

want to know

more?

FRANKFURT.

Meet us at the ACAMS Europe Assembly on 12th and 13th May.

Or anytime in our office right next to the Frankfurt Fair in TechQuartier.

ONLINE.

Webinar-Recording: Stronger Together: Article 75 and a new era of AML Collaboration.

Luckily, there is no rule to not talk about the spotixx data sharing platform – instead we are super happy to discuss with you. Leave us a message and let‘s fight crime – together.